New Bill Would Give American Companies First Access to Most Powerful AI Chips Before Foreign Sales

When Silicon Dreams Meet Political Reality: America's Quest for AI Supremacy

WASHINGTON — In the high-stakes world of artificial intelligence development, a fundamental question has emerged: should American companies have first access to the most powerful computer chips in the world?

The scarcity of advanced semiconductors has reached such critical levels that lawmakers are now considering unprecedented intervention in global markets. Senator Jim Banks has introduced the "Guaranteeing Access and Innovation for National Artificial Intelligence" Act as an amendment to the National Defense Authorization Act, representing the most aggressive legislative attempt yet to prioritize American buyers in semiconductor allocation.

The proposed legislation would require exporters to provide United States buyers with right-of-first-refusal on advanced chips before any foreign sales, fundamentally altering how the world's most sophisticated computing hardware reaches its destinations. The bill specifically targets semiconductors with total processing power of 4,800 teraFLOPS or above—a threshold that encompasses not only data center accelerators but potentially some high-end gaming graphics cards.

A teraFLOP represents one trillion floating-point operations per second (FLOPs), which is a fundamental metric for quantifying a computer's processing power. This measurement is crucial for understanding how to gauge a system's computational performance, particularly in demanding tasks.

This legislative push comes amid months of policy turbulence. The Biden administration's "AI Diffusion Rule," implemented in January to restrict chip exports, was rescinded by the Trump administration in May. Subsequently, the White House negotiated an unusual arrangement allowing certain chip sales to China in exchange for a 15 percent revenue share to the United States government.

The semiconductor giant Nvidia has vocally opposed the proposed restrictions, with a company spokesperson calling the approach "self-defeating policy, based on doomer science fiction." The company argues that global sales expand markets for American businesses rather than deprive domestic customers of access.

The Architecture of Digital Sovereignty

Behind Nvidia's resistance lies a deeper tension over how America should compete in the artificial intelligence era. The GAIN AI Act emerges from lawmakers' recognition that in an economy increasingly defined by AI capabilities, access to computational resources has become tantamount to access to economic opportunity itself.

This threshold encompasses not only the data center accelerators that power large-scale AI training but potentially some high-end gaming graphics cards, reflecting lawmakers' understanding that the boundaries between consumer and professional AI hardware have dissolved. The legislation represents a fundamental shift from market-driven allocation to strategic resource management, treating computational capacity as critical infrastructure rather than commodity hardware.

"What we're witnessing is the emergence of silicon sovereignty as a core component of national competitiveness," observed a senior semiconductor industry analyst who requested anonymity due to ongoing policy sensitivities. "The question is whether legislative intervention can achieve what market forces have not."

The proposal specifically targets what lawmakers describe as an unfair prioritization of foreign buyers over American innovators, requiring exporters to demonstrate that domestic demand has been fully satisfied before pursuing international sales. This certification process would fundamentally alter the relationship between chip manufacturers and their global customer base.

Beyond the Bandwidth Bottleneck

Yet beneath the legislative rhetoric lies a more complex web of constraints that no amount of preferential access can immediately resolve. The semiconductor supply chain's true limitations extend far beyond final chip allocation, encompassing fundamental capacity constraints in high-bandwidth memory production, advanced packaging capabilities, and the specialized infrastructure required to deploy these systems effectively.

Modern AI installations consume power at unprecedented scales—a single rack of advanced servers can draw as much electricity as an entire traditional data center consumed just years ago. These systems require sophisticated liquid cooling infrastructure, specialized electrical distribution, and thermal management capabilities that can take months or years to implement properly.

"Priority access to chips becomes meaningless if you can't power them on," explained a data center infrastructure executive familiar with large-scale AI deployments. "We're seeing customers with millions of dollars in hardware sitting in warehouses because they lack the electrical capacity or cooling systems necessary for operation."

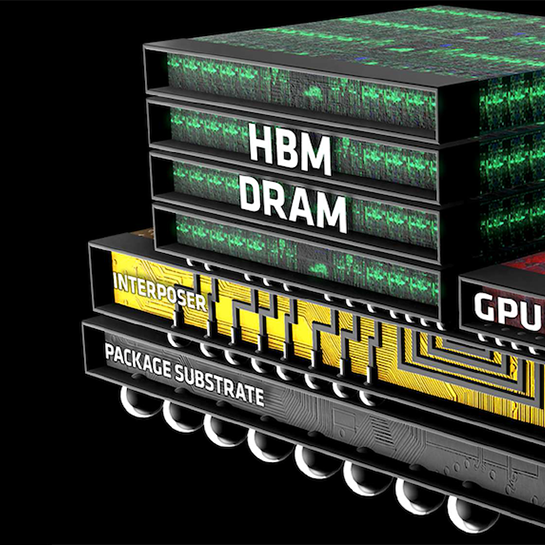

This infrastructure reality has created an unspoken hierarchy in chip allocation, where manufacturers naturally prioritize customers who can immediately deploy their products over those who might warehouse them indefinitely. Taiwan Semiconductor Manufacturing Company's advanced packaging capacity, particularly its CoWoS technology, remains a critical bottleneck that operates independently of legislative mandates.

CoWoS, or Chip-on-Wafer-on-Substrate, is an advanced 3D integrated circuit packaging technology. Pioneered by TSMC, it allows for the precise stacking and integration of multiple chips, such as logic and High Bandwidth Memory (HBM), onto a silicon interposer and then a substrate, significantly boosting performance and power efficiency in high-end semiconductors.

The Geopolitical Calculus of Innovation

The proposed legislation risks creating significant diplomatic friction with allies who have aligned themselves with American technology export controls. Countries like Japan, South Korea, and Taiwan—critical partners in semiconductor manufacturing and strategic competitors to China—could find themselves relegated to secondary status despite their cooperation with U.S. strategic objectives.

Global semiconductor market share by region, illustrating the dominant positions of the US, South Korea, Taiwan, and China.

| Country | Advanced Foundry Capacity Market Share (2023) |

|---|---|

| Taiwan | 68% |

| South Korea | 12% |

| U.S. | 12% |

| China | 8% |

More significantly, the legislation could accelerate the very trend it seeks to counter: the development of alternative AI ecosystems beyond American influence. China's domestic semiconductor industry, already advancing rapidly with products like Huawei's Ascend 910C chips, would likely receive additional state support and market protection in response to tighter U.S. controls.

"Every restriction we impose creates market opportunities for competitors," noted a former Commerce Department official with extensive experience in export control policy. "We risk subsidizing the development of non-American AI stacks while simultaneously alienating the allies we need to maintain technological leadership."

The legislation also overlooks the complex economics of semiconductor production, where global sales volumes underwrite the massive research and development investments necessary to maintain technological advancement. Restricting international access could paradoxically weaken American companies' ability to fund next-generation innovations.

Market Dynamics and Memory Mathematics

The semiconductor industry's complexity extends far beyond the political narratives surrounding chip allocation. High-bandwidth memory production, dominated by South Korean companies like SK Hynix and Samsung, represents perhaps the most critical constraint in AI system deployment. These memory modules, which enable the rapid data access essential for artificial intelligence processing, operate on production cycles measured in quarters and years rather than weeks.

Advanced packaging capabilities, particularly TSMC's CoWoS technology that enables the sophisticated interconnections between processors and memory, represent another fundamental bottleneck. These industrial limitations operate independently of legislative intervention, suggesting that allocation preferences may redistribute scarcity rather than alleviate it.

"We're essentially rearranging deck chairs on the Titanic," observed a semiconductor equipment executive. "The fundamental constraints are industrial capacity, not allocation preferences."

Investment Landscapes and Strategic Positioning

For investors navigating this evolving landscape, the legislation's potential passage creates several distinct opportunities and risks that extend well beyond traditional semiconductor stocks. Companies focused on power and cooling infrastructure may benefit disproportionately as data center operators rush to prepare sites for potential chip deliveries under new allocation schemes.

Comparative stock performance of semiconductor designers (e.g., Nvidia), manufacturers (e.g., TSMC), and infrastructure companies (e.g., Vertiv) over the last two years.

| Company | 2024 Performance | 2025 YTD Performance (as of Sep 2025) | Trailing Twelve Months (TTM) Performance (as of Sep 2025) |

|---|---|---|---|

| Nvidia (NVDA) | 178.80% | 23.36% | 58.03% |

| TSMC (TSM) | 92.56% | 17.77% | 38.44% |

| Vertiv (VRT) | 136.82% | 18.24% | 66.93% |

Memory manufacturers, particularly those producing high-bandwidth memory, could experience sustained pricing power as fundamental bottlenecks persist regardless of chip allocation preferences. The legislation could accelerate investment in American semiconductor manufacturing capacity, potentially benefiting equipment manufacturers and specialty materials companies.

The proposal could also drive bifurcation in global technology markets, creating distinct product lines optimized for different regulatory environments. This trend would likely benefit companies capable of managing complex compliance requirements while potentially disadvantaging smaller players lacking regulatory expertise and scale.

"We're moving toward a world where semiconductor roadmaps are written as much in Washington as in Silicon Valley," observed a technology investment strategist. "Companies that can navigate both technical and political complexity will develop sustainable competitive advantages."

Financial markets may need to price in greater volatility around international revenue streams, particularly for companies with significant exposure to Chinese markets. The 15 percent revenue-sharing arrangement currently governing certain China-bound chip sales adds another layer of complexity to financial planning.

The Innovation Imperative

The GAIN AI Act reflects a broader struggle to balance free market principles with national security imperatives in an era where technological leadership increasingly determines geopolitical influence. Yet the legislation's binary approach—American buyers first, everyone else second—may prove inadequate for addressing the nuanced realities of global supply chains.

Alternative approaches might focus on capacity expansion rather than allocation preferences, potentially through targeted investment in American semiconductor infrastructure or deeper partnerships with allied nations. Such strategies could increase overall supply while maintaining security objectives, avoiding the zero-sum dynamics inherent in the current proposal.

As Congress debates the legislation's merits, the underlying forces driving it—the intersection of artificial intelligence capabilities with national competitiveness—will only intensify. The question is whether American policy can evolve quickly enough to shape these technological trends rather than merely react to them.

In the server farms across America and the venture-funded laboratories of Silicon Valley, the future of American innovation increasingly depends on decisions made in the committee rooms of Washington. The chips may fall where they may, but where they fall first has become a matter of national strategy rather than market forces alone.

House Investment Thesis

| Aspect | Summary & Analysis |

|---|---|

| The Act Itself | An amendment to the NDAA creating a Commerce Department licensing regime for exporting "advanced integrated circuits." Key mandates: U.S. right-of-first-refusal certification, no U.S. backlog, no better terms abroad, and exports cannot be used to undercut U.S. firms. Defines "advanced" with technical thresholds (e.g., TPP ≥ 2,400) and sets a policy to deny licenses for the most powerful chips (e.g., TPP ≥ 4,800). |

| Immediate Context | Follows the Commerce Department rescinding the Biden-era "AI Diffusion Rule" in May. The White House had previously allowed some China sales with a 15% "skim" to the U.S. Nvidia is hostile to broad diffusion controls. Chinese buyers still want compliant parts (e.g., H20), but demand is volatile due to politics. |

| Author's Take: Nature of the Law | This is a queue-management law, not a capacity law. The real 2026 bottlenecks are HBM supply, advanced packaging, and power/cooling infrastructure; this law reorders delivery but doesn't add these physical constraints. |

| Author's Take: Likely Outcome | Expect watering-down and carve-outs during the congressional conference process. Final law will likely keep "first-dibs" principles but leave denial thresholds to Commerce guidance and carve out allies to avoid WTO and political blowback. |

| Author's Take: Impact on Vendors | Compliance friction increases significantly (lawyer-heavy documentation). Companies like Nvidia/AMD will create more region-specific SKUs (e.g., H20, 5090D) to skirt technical thresholds, increasing working capital and SKU complexity. |

| Author's Take: China Substitution | China substitution accelerates (Huawei, Cambricon scale up) but remains behind at the performance frontier, especially for large-scale training. The U.S. moat remains intact, but the China TAM becomes stickier for domestic players. |

| Author's Take: Real Winner | Datacenter infrastructure is the real capex winner. AI power demand is driving investment in liquid cooling, on-site gas, and advanced nuclear PPAs. Lead times for MWs of power and cooling retrofits are a bigger deployment bottleneck than chip paperwork. |

| Subsector Positioning: GPUs | Base case: U.S. hyperscalers get priority. China revenue becomes "stop-go." Global backlogs and new roadmaps (Blackwell/Rubin) provide cushion. Watch margins on de-rated China SKUs. |

| Subsector Positioning: Foundry/Packaging | CoWoS (advanced packaging) remains the bottleneck through 2026. Any U.S. packaging onshoring is post-2027 relief, not a near-term solution. |

| Subsector Positioning: Memory (HBM) | HBM remains the primary choke point. Pricing/mix tailwinds persist. Cleanest AI exposure in the memory segment. |

| Subsector Positioning: Power/Thermal | Clear secular updraft from liquid cooling and MW-scale power bottlenecks. Fundamental demand is likely under-modeled. |

| Subsector Positioning: Networking/Optics | Unaffected by "first dibs" policy. Demand for 800G+ optics and fabrics rises as AI racks densify. |

| Subsector Positioning: China AI Silicon | Structural share gains in China driven by policy, but software/toolchain frictions and performance gaps cap global ambitions. High volatility. |

| Scenario A: Watered-Down | Allies carved out; Commerce retains discretion. Impact = administrative friction, not unit loss outside China. Overweight infrastructure; hold core NVDA/TSMC. |

| Scenario B: Hardline Passage | Export denials bite beyond China; potential collateral impact on halo GPUs. Near-term U.S. pricing power but faster China substitution and grey markets. Trim export-heavy names; rotate to HBM/infra. |

| Scenario C: Bill Stalls | Status quo (15% China skim) persists. Relief rally in global AI supply chain; no change to infrastructure bull case. |

| Key Risks to Monitor | 1. Grid surprise (fast power buildouts): Bullish infra/GPUs. 2. China policy swerve (mandatory domestic silicon): Bearish U.S. chip TAM. 3. Legal/WTO challenge: Mutes impact. 4. Packaging shock (e.g., earthquake): Major downside to GPU supply. |

| Key Performance Indicators (KPIs) | 1. Final NDAA language on thresholds & carve-outs. 2. BIS licensing cadence & denial rates. 3. HBM/CoWoS disclosures from SK hynix/TSMC. 4. MW energized, cooling orders, nuclear PPAs from operators. 5. China revenue mix in NVDA/AMD earnings. |

| Bottom Line: Policy | The Act is symbolism with teeth—biting on paperwork and timelines, not supply physics. Expect a softer final version. |

| Bottom Line: Strategy | Remain overweight infrastructure scarcity (HBM, packaging, power/cooling) and core secular plays (NVDA/TSMC), while managing China exposure tactically. |

| Bottom Line: China | Domestic chips fill gaps faster but frontier training still requires Nvidia for 12-24 months. China exposure is tactical, not thesis-defining. |

NOT INVESTMENT ADVICE