Open-Source Secrets Management Platform Infisical Secures $16M Series A to Challenge Enterprise Security Giants

Open-Source Disruptor Infisical Raises $16M to Challenge Enterprise Secrets Management Status Quo

Infisical, the open-source secrets management platform that has quietly amassed over 100,000 developers since its inception, announced today it has secured $16 million in Series A funding led by prominent technology investor Elad Gil, with participation from Y Combinator, Gradient, Dynamic Fund, and notable angels including Datadog CEO Olivier Pomel and Samsara CEO Sanjit Biswas.

The investment comes at a pivotal moment for the San Francisco-based startup, which has achieved remarkable growth metrics: 20x revenue expansion year-over-year, cash flow positivity, and over 40 million downloads of its software globally. At its core, Infisical addresses one of the most critical yet underserved areas of enterprise security – how organizations manage, distribute, and secure the sensitive credentials that connect their increasingly complex technological ecosystems.

From GitHub Stars to Enterprise Boardrooms

What began as an open-source project has rapidly transformed into an essential infrastructure layer for organizations ranging from AI pioneer Hugging Face to consumer electronics giant LG. Infisical's platform now secures over 10 billion secrets per month, positioning it as a formidable challenger to established solutions from cloud providers like AWS Secrets Manager and enterprise-focused vendors such as CyberArk and HashiCorp.

"The secrets management landscape has historically forced companies to choose between robust security and developer experience," explains a senior security architect. "Infisical's innovation lies in refusing this false dichotomy – they've built enterprise-grade security with a genuine focus on how developers actually work."

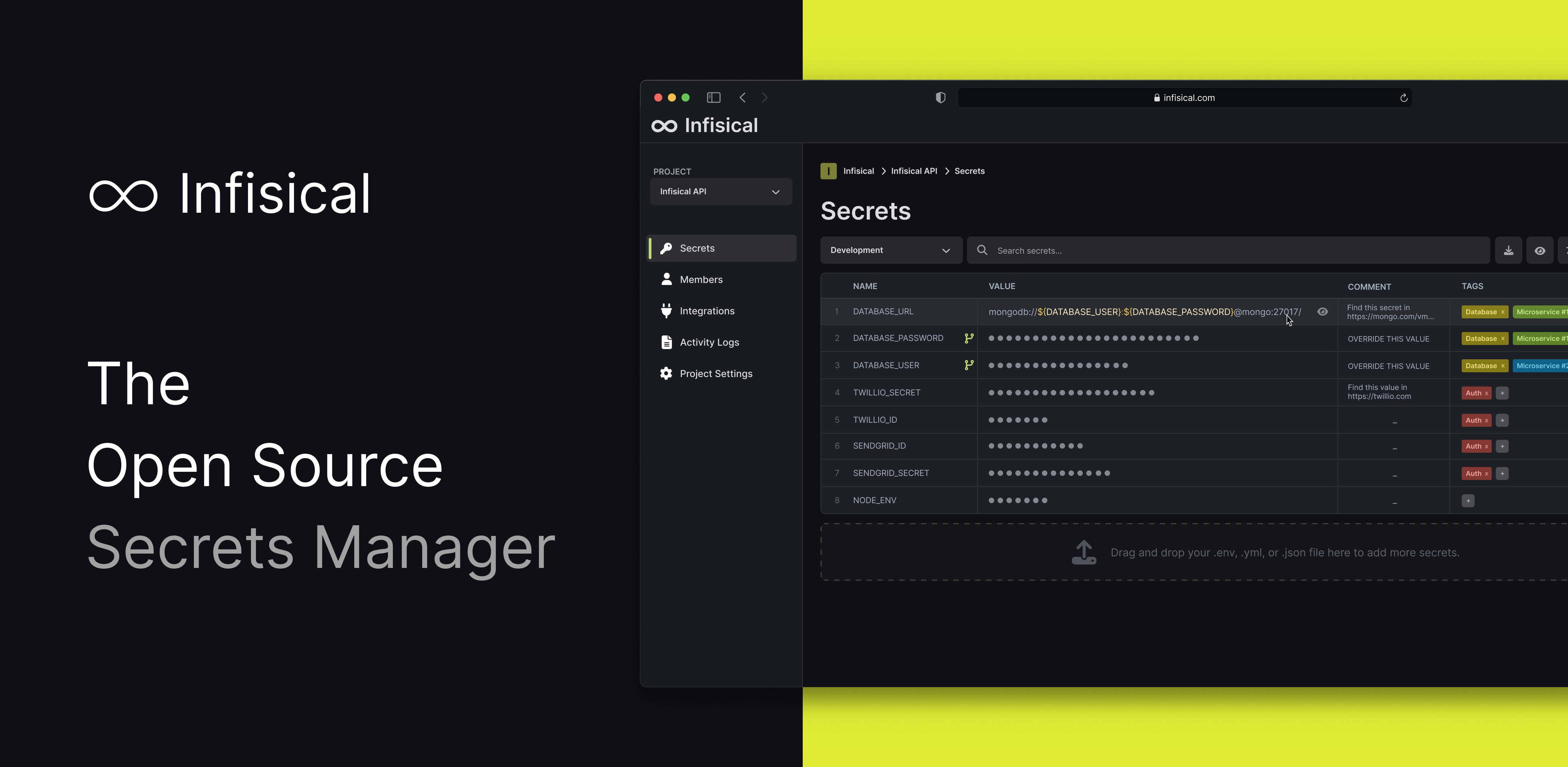

This developer-first approach represents a strategic departure from traditional enterprise security tools, which often prioritize compliance checkboxes over usability. In an era where developer productivity directly impacts business outcomes, Infisical's intuitive interface for managing API keys, database credentials, certificates, and SSH keys has resonated strongly with both technical teams and security leadership.

The $5.6 Billion Market Opportunity Nobody's Talking About

Behind Infisical's rapid traction lies an expanding market opportunity. According to industry research, the global secret management software market, valued at $1.5 billion in 2024, is projected to reach $5.6 billion by 2033, growing at a 16.5 percent CAGR from 2026 to 2033. The enterprise key management segment specifically is expected to surge from $2.99 billion in 2024 to $3.55 billion in 2025 – an 18.9 percent year-over-year increase.

This growth is being fueled by several converging factors: the proliferation of microservices architectures, the shift to multi-cloud environments, increasingly stringent regulatory requirements, and the emerging needs of AI workloads that require dynamic credential provisioning.

"We're witnessing a fundamental restructuring of how organizations think about secrets management," notes a cybersecurity analyst from a leading research firm. "As companies shift from monolithic applications to distributed systems with hundreds or thousands of microservices, traditional approaches simply don't scale. Add in compliance requirements and multi-cloud complexity, and you have a perfect storm driving demand for solutions like Infisical."

Secret Sprawl: The Hidden Security Crisis

The investment comes amid growing awareness of "secret sprawl" – the proliferation of hardcoded credentials and API keys across codebases, configuration files, and CI/CD pipelines. Security researchers have documented a twofold increase in leaked secrets on GitHub between 2020 and 2021 alone, highlighting the magnitude of this often-overlooked vulnerability.

Vlad Matsiiako, CEO and co-founder of Infisical, frames the problem in stark terms: "Secrets management serves as a critical foundation that connects all infrastructure components within any organization, making it incredibly important from both security and reliability perspectives."

The company's approach has resonated particularly in environments where developers need to move quickly without compromising security – a balance that has proven elusive for many organizations. By offering an exceptional developer experience without sacrificing robust security controls, Infisical has found a sweet spot that appeals to both technical practitioners and security leaders.

David vs. Cloud Goliaths

Infisical's rise hasn't occurred in a vacuum. The company faces entrenched competition from cloud hyperscalers like AWS, Azure, and Google Cloud, all of which offer native secrets management solutions tightly integrated with their respective platforms. Legacy security vendors with broader identity and access management portfolios, including CyberArk and Thycotic, also compete for enterprise wallet share.

What distinguishes Infisical is its cloud-agnostic, open-source foundation, which enables organizations to avoid vendor lock-in while maintaining consistent secrets management practices across diverse infrastructure footprints. This positioning as a neutral platform resonates particularly with organizations pursuing multi-cloud strategies or those wary of becoming overly dependent on a single provider's ecosystem.

The Road Ahead: Identity, Access, and AI Security

With the fresh capital infusion, Infisical plans to expand beyond its core secrets management capabilities into adjacent domains including identity and access management. The company also intends to develop specialized security infrastructure for AI agents and workloads – a forward-looking bet on the unique security challenges posed by increasingly autonomous AI systems.

However, industry observers note several challenges ahead. To penetrate highly regulated industries like financial services and healthcare, Infisical will need to secure and maintain rigorous compliance certifications such as SOC 2 Type II and ISO 27001. The company will also need to carefully navigate the balance between its open-source roots and enterprise monetization strategy to sustain growth.

"Infisical's biggest opportunity is also its greatest challenge," observes a venture capital investor focused on enterprise infrastructure. "They've built tremendous goodwill with developers through their open-source approach, but converting that into sustainable enterprise revenue requires threading a delicate needle."

Investment Perspective: Market Signals and Opportunities

For investors monitoring the cybersecurity landscape, Infisical's funding round signals growing institutional interest in foundational security infrastructure. The participation of strategic angels from companies like Datadog and Samsara suggests potential synergies between Infisical's platform and broader observability and IoT ecosystems.

From an investment standpoint, several factors merit attention:

-

Consolidation Potential: The secrets management space may be ripe for consolidation as larger security vendors seek to build comprehensive platforms. Infisical's rapid growth and developer adoption could make it an attractive acquisition target for companies looking to strengthen their security portfolios.

-

Enterprise SaaS Metrics: Infisical's achievement of cash flow positivity with 20x revenue growth is unusual for early-stage security startups, suggesting strong unit economics and efficient go-to-market execution.

-

AI Security Frontier: Infisical's stated intention to develop security infrastructure for AI workloads positions it at the intersection of two high-growth markets – cybersecurity and artificial intelligence.

As with any early-stage investment, potential risks include execution challenges in scaling enterprise sales, competition from well-resourced incumbents, and the complexity of expanding from a focused product to a broader platform. Investors should consider how Infisical's approach to balancing open-source community engagement with commercial priorities will impact its long-term competitive positioning.

Disclaimer: This analysis is based on current market data and established economic indicators. Past performance does not guarantee future results. Readers should consult financial advisors for personalized investment guidance.