Quantum Computing's Chiplet Gambit: Rigetti's Technical Triumph Meets Commercial Reality

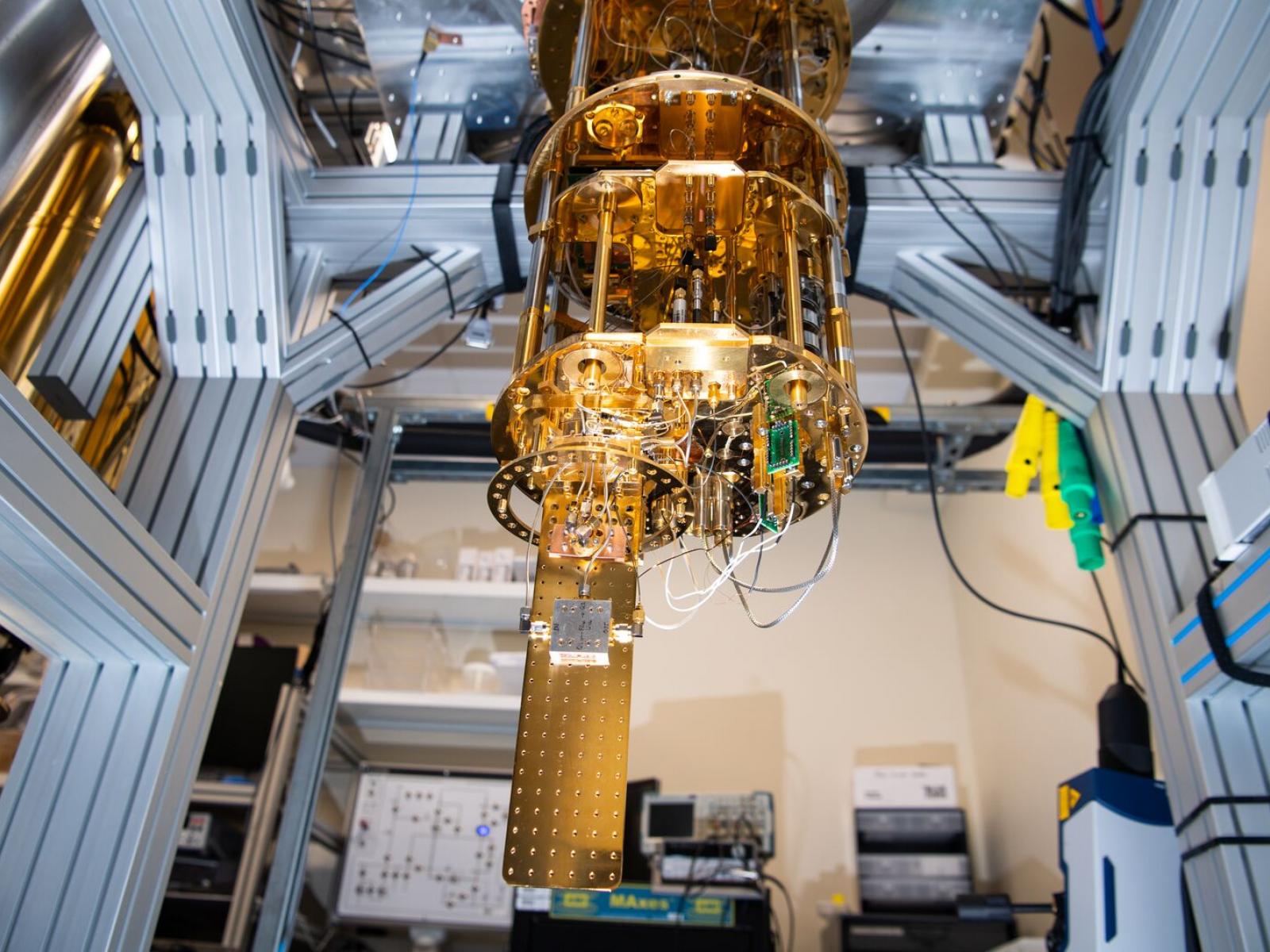

BERKELEY, California — In the sterile corridors of Rigetti Computing's quantum lab, where superconducting qubits operate at temperatures colder than deep space, a milestone that could reshape the quantum computing landscape has quietly emerged. The company's latest creation—a 36-qubit quantum computer built from four interconnected chiplets—represents more than technological advancement; it embodies a fundamental bet on how the quantum future will unfold.

The announcement of Rigetti's Cepheus-1-36Q system, achieving 99.5% median two-qubit gate fidelity while demonstrating the industry's first multi-chip quantum computer at this performance level, arrives at a critical juncture for the quantum computing sector. With $571.6 million in cash reserves following a substantial equity raise, Rigetti finds itself financially fortified yet commercially challenged, posting modest revenues of $1.8 million against a $39.7 million net loss in the second quarter.

Rigetti Computing's Q2 2025 financial performance, showing revenue versus net loss.

| Quarter | Revenue | Net Loss |

|---|---|---|

| Q2 2025 | $1.8 million | $39.7 million |

| Q1 2025 | $1.5 million | $21.6 million (operating loss) |

| Q4 2024 | $2.3 million | $153.0 million |

"We believe quadrupling our chiplet count and significantly decreasing error rates is the clear path towards quantum advantage and fault tolerance," noted Dr. Subodh Kulkarni, Rigetti's CEO, reflecting the company's conviction that modular architecture will prove decisive in the quantum race.

The Architecture of Ambition

Rigetti's chiplet approach represents a fundamental departure from the monolithic quantum processor designs favored by many competitors. By connecting multiple quantum processing units—each a sophisticated feat of superconducting engineering—the company addresses one of quantum computing's most persistent challenges: scaling qubit count while maintaining performance integrity.

The technical achievement is substantial. Cepheus-1-36Q demonstrates a twofold reduction in two-qubit gate error rates compared to Rigetti's previous Ankaa-3 system, a progression that industry observers suggest validates the chiplet scaling methodology. The system's architecture leverages proprietary inter-module couplers and enhanced tunable designs, technological innovations that enable quantum operations across chip boundaries—a feat analogous to orchestrating a symphony across multiple concert halls.

A qubit is the fundamental unit of quantum information, capable of representing not just a 0 or a 1, but a combination of both simultaneously. Gate fidelity is a crucial metric that measures how accurately a quantum gate performs its intended operation on a qubit, with high fidelity being essential for building reliable and powerful quantum computers.

Industry analysts point to the significance of maintaining high fidelity across a multi-chip architecture. "Cross-chip couplers, calibration overhead, and timing synchronization typically degrade performance," explained one quantum systems expert familiar with Rigetti's approach. "Achieving 99.5% median fidelity across four chiplets suggests their packaging and control stack is maturing beyond prototype stages."

The company's roadmap extends this architecture toward a 100+ qubit system targeted for release before year-end 2025, maintaining the same 99.5% fidelity standard—an ambitious timeline that could position Rigetti among the leaders in practical quantum utility.

Revenue Reality Check

Yet technical prowess alone does not translate to market dominance. Rigetti's Q2 financial results reveal the stark gap between quantum potential and commercial reality. The company's $1.8 million in quarterly revenue, while supporting ongoing operations, pales against the $20.4 million in operating expenses required to maintain its competitive position.

The broader quantum computing sector presents a study in contrasts. IonQ, Rigetti's publicly traded rival, reported $20.7 million in Q2 revenue—an 82% year-over-year increase—while raising its full-year guidance to $82-100 million. The trapped-ion quantum company has also completed strategic acquisitions worth approximately $1.1 billion, building a comprehensive quantum ecosystem that extends beyond pure computing into networking and sensing applications.

Q2 2025 revenue comparison for publicly traded quantum computing companies, highlighting the gap between IonQ, D-Wave, and Rigetti.

| Company | Q2 2025 Revenue (in millions) |

|---|---|

| IonQ | $20.7 |

| D-Wave | $3.1 |

| Rigetti | $1.8 |

D-Wave, the quantum annealing specialist, posted $3.1 million in Q2 revenue with 42% year-over-year growth, demonstrating that focused quantum applications can generate meaningful commercial traction. The company's Advantage2 system, featuring over 1,200 qubits, has found particular resonance in optimization applications across multiple industries.

"The market is rewarding revenue scale and customer backlog more than raw qubit headlines," observed one industry analyst tracking quantum computing investments. "Rigetti now faces pressure to bend its revenue curve, or risk remaining categorized as a science project with substantial runway."

The Competitive Quantum Landscape

The quantum computing sector increasingly resembles a multi-dimensional chess match, with different players pursuing distinct technological pathways toward quantum advantage. While Rigetti advances its superconducting chiplet architecture, competitors are making parallel progress across alternative approaches.

Several competing approaches are vying to build practical quantum computers, with leading methods including superconducting circuits, trapped ions, and quantum annealing. Each technology presents a unique set of advantages and challenges, making the field a dynamic area for development and investment.

IBM and Google, leveraging massive research budgets and academic partnerships, continue pushing toward error-corrected quantum systems capable of supporting millions of qubits by decade's end. Their focus on logical qubits and sophisticated error correction protocols represents a long-term bet on fault-tolerant quantum computing that could ultimately determine industry leadership.

Quantinuum, formed through the merger of Honeywell Quantum Solutions and Cambridge Quantum Computing, has achieved notable milestones in error correction, recently demonstrating 12 logical qubits on their H2 system in collaboration with Microsoft. These advances in error-corrected quantum operations represent progress toward practical quantum advantage that extends beyond the current Noisy Intermediate-Scale Quantum (NISQ) era.

Microsoft's Azure Quantum platform serves as a critical battleground for quantum cloud services, where Rigetti's upcoming availability alongside established players like IonQ and Quantinuum will test market reception of its chiplet architecture. The platform's enterprise reach and integration capabilities could prove decisive in converting technical achievements into commercial success.

Investment Implications and Market Dynamics

From an investment perspective, Rigetti's current position presents both compelling opportunities and significant risks. The company's substantial cash position—$571.6 million with no debt following the $350 million at-the-market equity offering—provides multiple years of operational runway to execute its ambitious roadmap.

However, the quantum computing sector's investment dynamics favor companies demonstrating clear paths to revenue scalability. IonQ's recent performance, combining strong revenue growth with strategic expansion through acquisitions, has established it as the sector's commercial leader among pure-play quantum companies.

Year-to-date stock performance comparison of pure-play quantum computing companies like Rigetti (RGTI) and IonQ (IONQ).

| Company | Ticker | Year-to-Date (YTD) Performance |

|---|---|---|

| D-Wave Quantum | QBTS | 106.98% |

| IonQ | IONQ | 7.65% |

| Rigetti Computing | RGTI | 4.72% |

| Quantum Computing Inc. | QUBT | -14.00% |

Market analysts suggest several scenarios for Rigetti's trajectory. A successful deployment of its 100+ qubit system with demonstrated application-level advantages could drive revenue into the $15-25 million annual range, potentially supporting valuation multiples comparable to other quantum leaders. Conversely, execution delays or competitive advances in logical qubit technologies could pressure the company's market position.

"Position Rigetti as a catalyst-driven exposure rather than a core compounding investment," recommended one technology-focused portfolio manager. "The chiplet architecture represents a legitimate technical differentiation, but commercial validation remains the critical unknown."

The Path Forward

Rigetti's immediate challenges extend beyond pure technology development. The company must demonstrate that its chiplet architecture translates into practical advantages for real-world applications—whether in chemistry simulation, materials science, or optimization problems that resist classical computational approaches.

The upcoming availability on Microsoft Azure represents a crucial test of market reception. Enterprise customers evaluating quantum computing solutions increasingly demand benchmarked performance data and clear cost-benefit analyses rather than abstract qubit counts or gate fidelities.

Industry observers suggest that Rigetti's success will ultimately depend on its ability to productize quantum advantages around specific workload categories. This requires not only technical excellence but sophisticated software toolchains, compiler optimizations, and error mitigation strategies that demonstrably outperform classical alternatives within defined problem domains.

As the quantum computing sector approaches a potential inflection point between experimental systems and practical utility, Rigetti's chiplet gambit represents both technical innovation and strategic risk. The company's substantial financial resources provide the runway necessary to pursue ambitious goals, but market dynamics increasingly favor proven commercial traction over technical potential alone.

The quantum revolution, long promised and perpetually "five years away," may finally be approaching commercial viability. Whether Rigetti's modular architecture proves decisive in this transformation will determine both the company's future and the broader trajectory of quantum computing's emergence from laboratory curiosity to computational reality.

Investment Disclaimer: Past performance does not guarantee future results. Quantum computing investments carry substantial technical and commercial risks. Readers should consult qualified financial advisors before making investment decisions based on emerging technology sectors.