Salient Raises $60 Million to Transform Loan Servicing with AI Technology

AI Loan Servicing Breakthrough: Salient's $60M Windfall Signals New Era in Financial Technology

The gleaming office towers of Silicon Valley have long cast shadows over the staid world of loan servicing, but the gap between cutting-edge technology and traditional banking infrastructure is finally narrowing. Salient, an AI-native financial technology provider founded in 2023, has secured a substantial $60 million funding round led by Andreessen Horowitz and Matrix Partners, with participation from Y Combinator and entertainment mogul Michael Ovitz, valuing the company at $350 million.

This investment arrives at a critical inflection point in financial services technology. While loan origination has seen waves of innovation, the servicing side—encompassing collections, compliance, and customer communications—has remained stubbornly anchored to manual processes and fragmented systems.

The Billion-Dollar Breakthrough

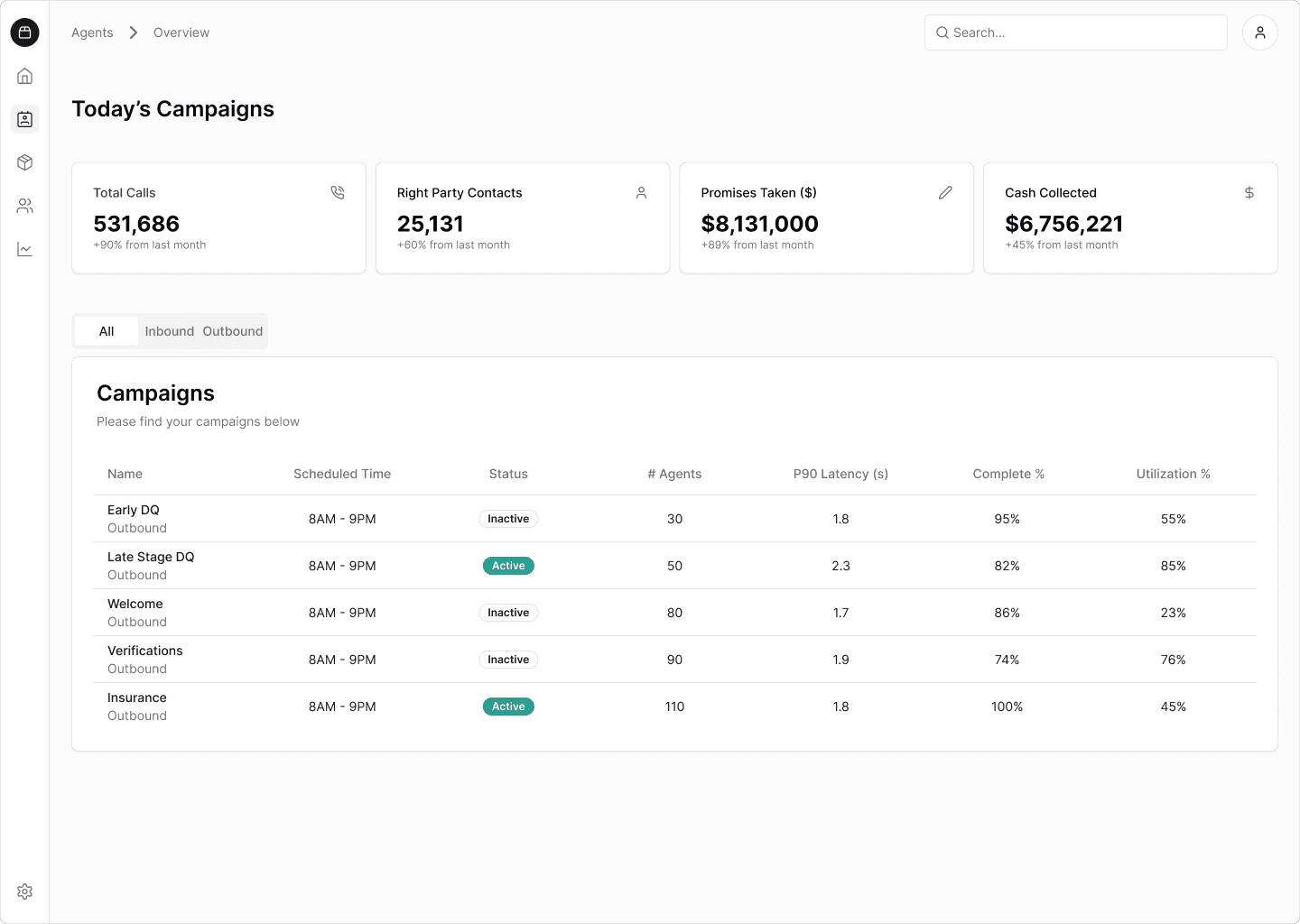

In less than two years since its launch, Salient has processed over $1 billion in transactions through its AI-powered platform. The company has achieved an annualized run rate exceeding $14 million while serving marquee clients including Westlake Financial, American Credit Acceptance, Exeter Finance, and three publicly listed banks.

"This platform isn't just incremental improvement—it's a fundamental reimagining of loan servicing infrastructure," noted a financial technology analyst familiar with Salient's operations. "The 60% reduction in handle times they're delivering represents millions in operational savings for lenders."

Indeed, Westlake Financial alone reported annual savings of $12 million while simultaneously reducing customer friction, a rare combination in an industry where efficiency often comes at the expense of user experience.

The Perfect Storm: Why Now?

Several converging forces have created ideal conditions for Salient's approach to gain traction:

Delinquencies Rising, Regulatory Scrutiny Intensifying

U.S. household debt reached $18.2 trillion in Q1 2025, with 4.3% classified as delinquent—the highest rate in five years. Student loan serious delinquencies have spiked to 8%, creating urgent demand for more sophisticated servicing solutions.

Meanwhile, regulatory bodies are tightening their grip. The Consumer Financial Protection Bureau's January 2025 circular explicitly placed "complex algorithms" in debt collection under supervisory scope, while the EU AI Act, going live in August 2025, classifies credit and collections as "high-risk," mandating auditable data logs and human oversight.

The Economics of AI Have Transformed

Perhaps most significantly, the unit economics of implementing AI have fundamentally shifted. GPT-4o-mini realtime pricing fell significantly to $0.60 / 1M input tokens, making economically viable 24/7 voice agents a reality for the first time.

"We're witnessing a step-function change in spend," explained a banking technology consultant. "What was prohibitively expensive eighteen months ago now offers compelling ROI, especially when you factor in compliance risk reduction."

Three-Pronged Attack on Legacy Systems

Salient's platform consists of three integrated components that work in concert:

- AI Agent Platform: Automates multichannel customer communications across voice, text, and email

- AI Compliance Monitoring Suite: Ensures regulatory adherence at the token level

- Servicing Automation Platform: Delivers portfolio insights, fraud detection, and workflow automation

What distinguishes this approach is its compliance-as-code architecture. Unlike bolt-on AI modules being rushed to market by incumbents, Salient's platform embeds regulatory guardrails (FDCPA, FCRA, TCPA) directly into every customer interaction and workflow.

David vs. Multiple Goliaths

The competitive landscape Salient navigates is formidable. Black Knight (now owned by ICE) controls approximately 65% of the U.S. mortgage servicing market, while financial technology titans FIS and Fiserv serve the majority of large banks and credit unions through entrenched relationships.

Several specialized competitors are also vying for market share:

- TrueAccord has raised $153 million for its machine-learning-driven collections platform

- Credgenics, an India-based SaaS provider, reported ₹220 crore (~$27 million) revenue with 40% year-over-year growth in FY 2024-25

- CreditNirvana, recently acquired by Perfios, manages a $9 billion portfolio across 42 million accounts

Market analysts suggest the global loan servicing market, valued at $3.5 billion in 2024, will expand to $10.5 billion by 2033 at a compound annual growth rate of 14.73%. The AI-enhanced segment is growing even faster—from $4.8 billion in 2024 to a projected $19.1 billion by 2033.

The Integration Challenge

Despite compelling economics, hurdles remain. Seamless connectivity with legacy core banking systems requires bespoke engineering and often prolongs onboarding cycles.

"The technology is proven, but getting it plugged into decades-old infrastructure remains the friction point," observed a digital banking consultant. "Salient needs to compress integration timelines from 3-6 months down to 4-6 weeks to capture the mid-market financial institution segment."

Other challenges include model drift, potential algorithmic bias, and the handling of sensitive personally identifiable information at scale.

The Investment Equation

For investors eyeing this sector, several metrics merit close attention.

Integration Velocity

The time from contract to implementation remains the critical constraint on growth. Companies that can reliably deploy within 45 days will capture disproportionate market share.

Net Revenue Retention

Successful platforms in this space should maintain retention rates above 135% through cross-selling additional modules such as dispute resolution, insurance processing, and bankruptcy management.

Margin Sustainability

As voice volumes increase tenfold, maintaining gross margins above 80% will separate winners from also-rans, particularly as firms navigate Twilio and OpenAI unit-cost pass-through considerations.

Investment Perspective

The loan servicing sector appears poised for substantial disruption, with AI-native platforms like Salient potentially capturing significant market share from legacy providers. While current valuations (approximately 25x ARR) reflect optimistic growth projections, the fundamental economics of the industry support continued expansion.

Three potential exit scenarios emerge for companies in this space:

- Strategic acquisition by incumbents like ICE or FIS (2027-2028 timeframe)

- Public market debut once reaching $200 million ARR

- Private equity-driven consolidation with complementary AI voice BPO providers

Industry experts suggest there's approximately a 50% probability of strategic exit, 30% chance of IPO, and 20% risk of underperformance.

Past performance is not indicative of future results. This analysis is based on current market data and established patterns but represents an informed perspective rather than guaranteed outcomes. Readers should consult financial advisors for personalized investment guidance.