Zoom's Agentic AI Gambit: Betting Big on Autonomous Workplace Intelligence

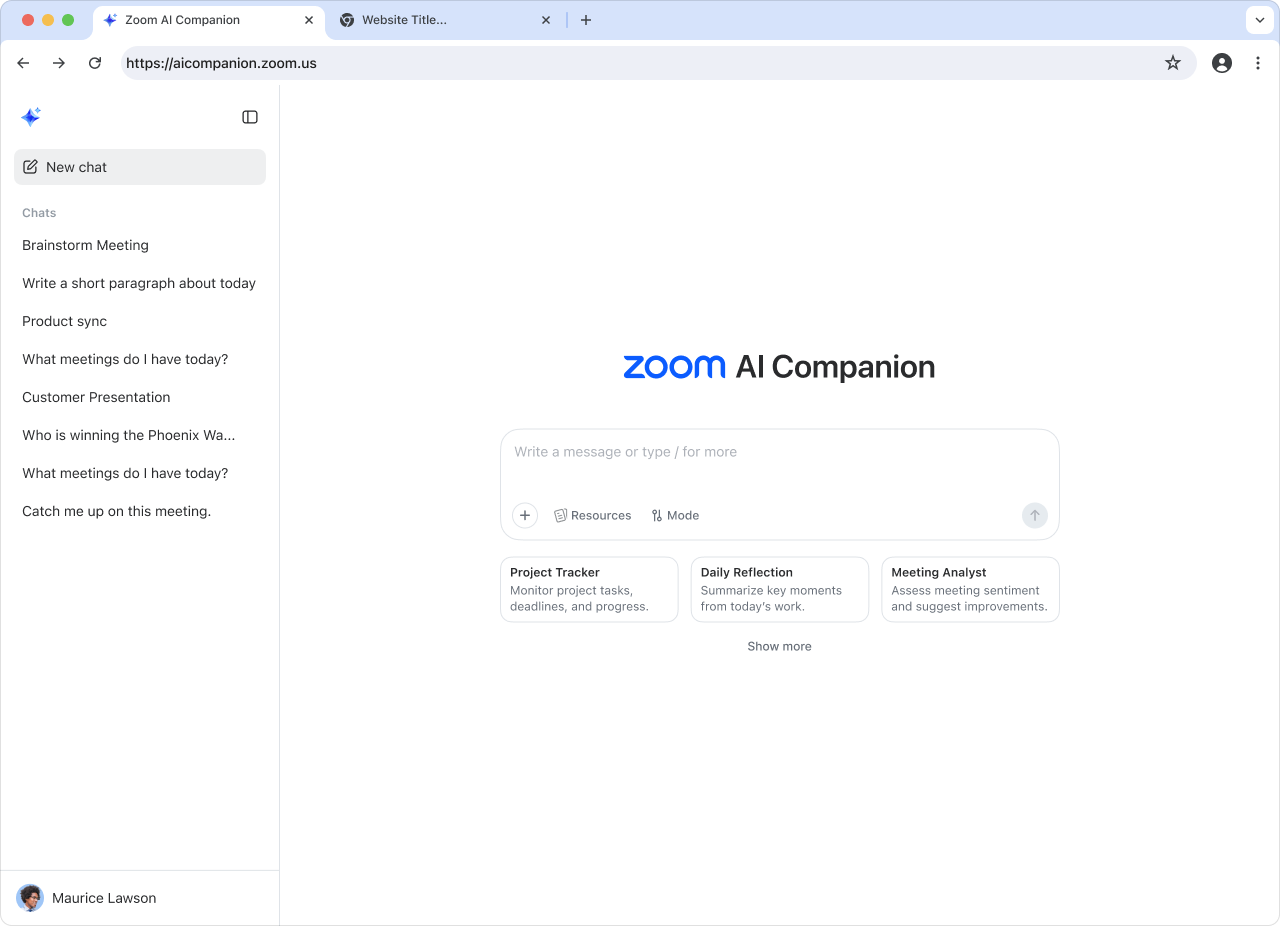

Zoom Communications unveiled its most ambitious artificial intelligence strategy yet on Wednesday, introducing AI Companion 3.0 with what the company calls "agentic AI" capabilities that promise to transform conversations into automated actions across multiple platforms. The announcement at Zoomtopia 2025 signals a decisive pivot beyond meeting software toward autonomous workplace intelligence, positioning the company to capture a share of what analysts project as a $100 billion workplace AI market by 2030.

The San Jose-based communications giant is wagering that businesses will pay premium prices for AI agents that can execute complex workflows autonomously, rather than simply assist with suggestions and summaries. This represents a fundamental shift from reactive copilots to proactive digital workers—a frontier that could redefine enterprise productivity.

🚀 Zoom New Releases (Sept–Dec 2025)

| Category | Key Features | Availability |

|---|---|---|

| AI Companion 3.0 | Proactive tasking, smart scheduling, cross-platform note-taking, retrieval, meeting prep | Sept–Dec 2025 |

| Custom AI Companion | Custom agent builder, SharePoint/ServiceNow connectors, Agent2Agent with ServiceNow | Sept–Dec 2025 |

| Workplace Enhancements | AI avatars, voice translation, enhanced A/V, Whiteboard & Team Chat AI, Phone AI | Sept–Dec 2025 |

| Video Management | Centralized video hub + LMS integrations | Sept 2025 |

| Hardware | Jabra-certified frontline headsets | Oct 2025 |

Beyond Meetings: The Cross-Platform Convergence Strategy

AI Companion 3.0's most significant departure from traditional meeting assistants lies in its cross-platform ambitions. The system will integrate not only with Zoom's native ecosystem but also with Microsoft Teams, Google Meet, and Cisco WebEx—a neutral positioning that directly challenges the walled-garden approaches of tech giants.

The platform promises to synthesize internal enterprise knowledge from meeting transcripts, chat histories, and shared documents with external market research and industry data through unified search capabilities. Users can optimize manual notes with AI assistance across all meeting platforms, including in-person gatherings, with general availability targeted for November 2025.

Industry experts suggest this interoperability approach could accelerate adoption among enterprises running mixed technology stacks. The strategy leverages Zoom's position as a communications hub while avoiding direct confrontation with Microsoft and Google in their core productivity domains.

The $12 Custom Agent Economy

Zoom's monetization strategy centers on a two-tiered approach: core AI features included with paid Workplace accounts, and Custom AI Companion priced at $12 per user monthly for organizations requiring tailored solutions. The Custom AI Companion features a low-code builder enabling administrators to create and deploy specialized agents using pre-built templates and comprehensive tooling libraries.

The pricing structure positions Zoom competitively against point solutions while encouraging experimentation across enterprise client bases. Market observers note that the $12 add-on represents classic high-margin upsell potential, with revenue sensitivity dependent on attachment rates to paid seats.

Supporting this strategy is the Agent2Agent protocol integration, allowing inter-agent communication across applications, and Model Context Protocol support for tool configuration. These technical foundations could enable enterprises to build sophisticated automation networks spanning multiple business systems.

Contact Center Gold Rush Accelerates

Zoom's Business Services expansion extends agentic AI into customer experience and sales automation, areas where the company has demonstrated strong competitive traction. The Contact Center as a Service segment has delivered high double-digit growth rates, with competitive displacements driving increasing numbers of $100,000-plus annual recurring revenue customers.

New capabilities include Expert Assist for automating support agent tasks, CX Insights for business intelligence extraction from customer data, and Automated Quality Management extending oversight to virtual agent interactions. The Revenue Accelerator introduces agentic prospecting that scans event lists, identifies prospects, initiates personalized outreach, and schedules initial touchpoints.

Analysts view the CCaaS momentum as particularly significant because contact center deployments typically involve far more seats than traditional meeting solutions, creating substantial revenue multiplication potential. The company reports that four out of five CCaaS wins come through channel partners, emphasizing the importance of strong partner enablement for scaling agentic AI adoption.

Microsoft's Bundling Pressure Intensifies Competition

The competitive landscape presents both opportunity and substantial risk for Zoom's agentic AI ambitions. Microsoft's aggressive bundling strategy, reportedly consolidating Sales, Service, and Finance Copilots into core M365 Copilot at $30 per user monthly, creates intense pricing pressure for standalone solutions.

Google's advancement of Gemini integration with Meet, coupled with Cisco's WebEx AI developments, suggests the market is rapidly evolving toward comprehensive AI-native collaboration platforms. Industry analysts observe that Microsoft's ownership of email, documents, spreadsheets, and calendar systems provides inherent advantages in workflow completion—the ultimate battleground for agentic AI effectiveness.

However, market specialists suggest Zoom's neutral interoperability stance could prove advantageous among enterprises seeking to avoid vendor lock-in. The company's massive installed base of hundreds of millions of users provides substantial distribution leverage for AI feature adoption.

Execution Risks and Market Reality Check

Despite the compelling vision, several execution challenges could determine whether Zoom's agentic AI strategy translates into sustainable revenue growth. Multi-step agents operating across enterprise systems must demonstrate exceptional reliability, with minimal hallucinations and robust security controls to maintain organizational trust.

Data governance presents another critical challenge, as unifying internal transcripts, documents, and chat with external data sources raises significant privacy and retention compliance issues. Enterprises will demand airtight administrative controls and transparent data handling practices.

The November 2025 general availability timeline appears aggressive given the scope of integration required. Any slippage in delivery dates or limited regional availability could undermine momentum generated by the Zoomtopia announcement.

Investment Implications and Forward-Looking Analysis

From an investment perspective, Zoom's agentic AI strategy represents a credible attempt to drive a second growth phase following the pandemic-era surge. The company has raised fiscal 2026 guidance twice based on AI adoption traction, suggesting early market validation.

Enterprise revenue growth has already outpaced Online segment growth at 7% versus 1-2% year-over-year, with acceleration observed in recent quarters. Agentic AI capabilities should further skew benefits toward Enterprise customers, potentially supporting sustained high-single-digit growth rates in that segment.

The Custom AI Companion add-on offers particularly attractive unit economics potential. Even modest mid-single-digit attachment rates in the Enterprise segment by fiscal 2027 could generate meaningful ARPU uplift, assuming successful interoperability delivery and demonstrable return on investment.

Market analysts suggest monitoring several key metrics over the next 90-180 days: actual AI Companion 3.0 feature availability at launch, concrete partner examples demonstrating Agent2Agent protocol effectiveness, Enterprise seat usage statistics, and Custom AI Companion paid seat adoption rates.

The Verdict on Zoom's Autonomous Future

While Zoom's agentic AI vision addresses legitimate enterprise pain points around fragmented workflows and administrative overhead, success depends heavily on execution quality and ecosystem partnership development. The company appears unlikely to displace Microsoft or Google as primary workplace productivity providers, but could establish leadership in communications-first agent workflows and contact center automation.

The investment case hinges on Zoom's ability to deliver reliable, enterprise-grade autonomous agents by late 2025 while maintaining pricing discipline against bundling pressure from larger competitors. For professional traders, this represents a execution-dependent growth story requiring careful monitoring of ship dates, feature scope, and early adoption metrics over the next two quarters.

Investors should note that past performance does not guarantee future results. These projections represent informed analysis based on current market data and should not substitute for personalized financial advice.