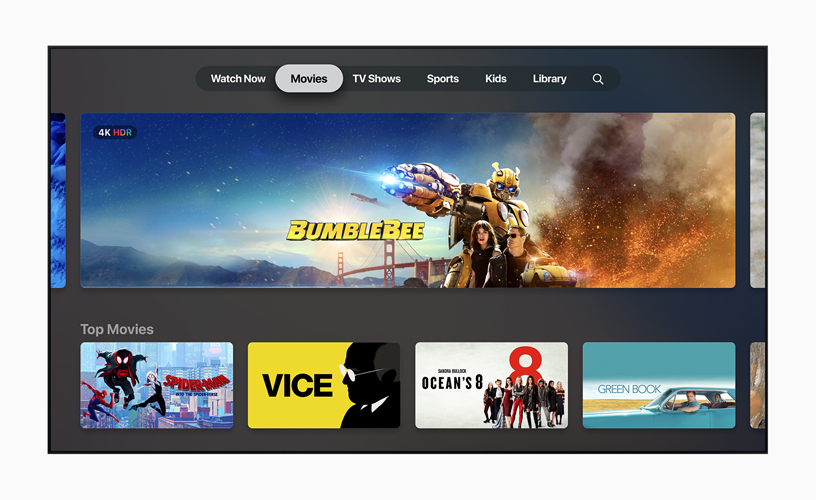

Apple TV+ Raises Monthly Price 30% to $12.99 as Streaming Services Continue Industry-Wide Cost Increases

The Streaming Inflation Spiral: Apple TV+ Signals Industry's New Economic Reality

CUPERTINO, California — Apple TV+, the technology giant's ad-free streaming service launched in November 2019, increased its U.S. monthly subscription price from $9.99 to $12.99 on Thursday, August 21, 2025—marking a 30% jump that positions the platform among the industry's premium-priced offerings.

The price adjustment applies immediately to new subscribers, while existing customers will see the higher rate 30 days after their next renewal cycle. Apple's annual subscription plan remains unchanged at $99.99, and the company has maintained pricing for its Apple One bundle packages, which combine streaming with music, storage, and gaming services.

This represents Apple TV+'s second significant price increase since launch. The service debuted at $4.99 monthly, rose to $6.99, then jumped to $9.99 in October 2023. The platform, which features exclusively original programming without advertisements, continues to differentiate itself from competitors by maintaining an ad-free model across all content.

Apple TV+ U.S. Monthly Subscription Price Evolution (2019-2025).

| Date | Price (USD) |

|---|---|

| November 2019 | $4.99 |

| October 2022 | $6.99 |

| October 2023 | $9.99 |

| August 2025 | $12.99 |

Apple cited its expanding catalog of original productions and ongoing weekly releases as justification for the increase. The service has invested heavily in prestigious content, including Emmy-nominated series and feature films, while reportedly losing over $1 billion annually according to industry estimates.

(Content amortization and production costs in streaming)

| Topic | Core point | Financial impact | Analyst takeaway |

|---|---|---|---|

| Content amortization | Capitalized content expensed over time, usually accelerated (front‑loaded) | Mostly sits in Cost of Revenues; dominates that line | Expect heavy early expense; long but small tail |

| Produced vs. licensed | Produced: capitalize production + overhead; Licensed: capitalize fee at window start | Both become content assets; amortized by usage/window | Window length and slate mix drive pace of expense |

| Patterns/assumptions | Usage-based curves informed by viewing forecasts | Early periods carry higher amortization | Changes in estimates adjust future periods only |

| Cash vs. P&L | Cash paid upfront/milestones vs. expense over years | Can show negative FCF while P&L spreads cost | Evaluate both cash spend and amortization roll-forward |

| Disclosures/policy | Often “~90% within ~4 years,” max life up to ~10 years | Footnotes outline method and any changes | Check if reported margins match disclosed pacing |

The price adjustment extends beyond U.S. markets to select international regions, though specific details vary by country. Notably absent from the increase are Apple's bundle offerings, creating a significant pricing gap between standalone and packaged subscriptions that industry observers view as strategically designed to encourage broader service adoption.

The Mathematics of Strategic Positioning

For Apple, the calculus extends beyond simple revenue optimization. The company's decision to maintain its annual plan at $99.99—effectively creating a 36% discount compared to monthly billing—reveals a sophisticated approach to customer lifecycle management. Industry sources suggest this strategy targets two critical objectives: reducing churn through longer-term commitments while steering price-sensitive consumers toward Apple One bundles that remain unchanged.

In subscription businesses, the churn rate measures the percentage of customers who cancel their service over a specific period. This metric is critical because it directly impacts the customer lifetime value (CLV), which is the total revenue a business can expect from a single customer. The fundamental goal is to minimize churn in order to maximize CLV, driving long-term profitability.

The financial mechanics underlying this approach demonstrate Apple's understanding of subscription economics. With an estimated 45 million Apple TV+ subscribers, approximately 70% utilizing monthly billing, the company faces a delicate balancing act. Revenue increases by 30% only if cancellation rates remain below 23.1%—a threshold that Apple's bundling strategy appears designed to protect.

"The pricing architecture here isn't about maximizing TV+ revenue in isolation," noted a senior analyst at a major investment firm who requested anonymity. "It's about reinforcing the entire Services ecosystem while gradually addressing what has been a billion-dollar annual loss center."

Industry-Wide Recalibration Reflects Deeper Economic Pressures

The synchronized nature of these price increases reflects broader economic realities that extend far beyond individual platform strategies. Content production costs have escalated dramatically, with original programming budgets reaching unprecedented levels as platforms compete for prestige projects and awards recognition. Simultaneously, the easy capital that funded the initial streaming wars has evaporated, replaced by investor demands for sustainable profitability.

This shift represents a maturation of the streaming industry from its venture-capital-fueled expansion phase to a more traditional media business model focused on cash generation. Netflix's success with its ad-supported tier—attracting 40 million monthly active users by May 2024—has validated a two-tier pricing structure that allows platforms to maintain premium offerings while capturing price-sensitive segments through advertising revenue.

Apple's resistance to introducing an ad-supported tier positions the company uniquely within this evolving landscape. While competitors leverage advertising to support lower-cost options, Apple maintains its premium, ad-free positioning across all subscription levels—a strategy that amplifies both the opportunities and risks associated with price increases.

Strategic Implications for Apple's Services Architecture

Within Apple's broader Services division, which generated $27.4 billion in quarterly revenue, TV+ remains financially immaterial. However, its strategic importance extends far beyond direct revenue contribution. The platform serves as a crucial component of Apple One bundles, which combine streaming, music, storage, and gaming services into integrated packages that significantly increase customer lifetime value and switching costs.

The decision to raise standalone TV+ pricing while maintaining bundle costs creates a powerful economic incentive for customer migration toward comprehensive service packages. This approach aligns with Apple's historical strategy of using individual product pricing to reinforce ecosystem adoption rather than optimizing standalone revenue streams.

Market analysts suggest this bundling strategy could prove particularly effective given the current economic environment. As consumers face multiple subscription price increases across platforms, the relative value proposition of comprehensive bundles becomes increasingly attractive, potentially driving Apple One adoption rates significantly higher.

Investment Implications and Market Dynamics

For investors analyzing Apple's strategic direction, the TV+ price increase offers several key insights into management's priorities and market positioning. The move demonstrates willingness to sacrifice potential subscriber growth in favor of improved unit economics—a shift that aligns with broader market expectations for Services division profitability optimization.

Unit economics in a subscription business analyze the profitability of a single customer by comparing their Lifetime Value (LTV) to the Customer Acquisition Cost (CAC). This LTV to CAC ratio is crucial for investors as it demonstrates whether the company's core business model is sustainable and can scale profitably over time.

The timing of this increase, following successful launches of high-profile content including Emmy-nominated productions, suggests Apple's confidence in its content quality and subscriber retention capabilities. However, the company faces increasing competitive pressure from platforms that offer both ad-supported and premium tiers, providing consumers with more granular pricing options.

Industry data indicates that streaming services with ad-supported options have maintained stronger subscriber growth rates while achieving higher overall revenue per user through combined subscription and advertising income. Apple's continued resistance to this model may limit its ability to compete on price while maintaining content investment levels necessary for platform differentiation.

Forward-Looking Market Positioning

The streaming industry's pricing evolution appears far from complete, with additional increases likely as platforms continue seeking sustainable profitability models. Apple's positioning as a premium, ad-free service provider offers both defensive advantages and strategic vulnerabilities in this environment.

Investment professionals should monitor several key metrics in coming quarters: Apple One bundle adoption rates, TV+ subscriber retention following the price increase, and any signals regarding potential ad-tier introduction. The company's ability to maintain premium pricing without ad revenue support will likely depend on continued content quality improvements and integration benefits within the broader Apple ecosystem.

Long-term investment implications suggest that Apple's Services strategy remains sound, with TV+ serving as a strategic asset rather than a standalone profit center. However, the platform's success in justifying premium pricing without advertising revenue will increasingly depend on Apple's ability to deliver content experiences that meaningfully differentiate from lower-cost alternatives.

Market Outlook and Strategic Recommendations

Current market dynamics suggest a bifurcation emerging within the streaming industry, with ad-supported tiers capturing price-sensitive consumers while premium offerings target audiences willing to pay for enhanced experiences. Apple's positioning in the premium segment offers potential advantages but requires continued investment in content quality and ecosystem integration.

Comparative market share of ad-supported vs. ad-free streaming services in the U.S. (2024–2025). Figures reflect subscription mix among services offering both tiers, plus momentum indicators and context.

| Metric | Ad-Supported | Ad-Free | Notes |

|---|---|---|---|

| Share of active subscriptions (Q1 2025) | ~46% | ~54% | Ad-supported up ~7 pp YoY; ad-free marginally down. |

| Share of active subscriptions (Q3 2024) | ~43% | ~57% | Ad-supported up ~11 pp YoY; strong 2024 momentum. |

| Share of gross additions (Q1 2025) | ~57–60% | ~40–43% | Majority of new sign-ups choose ad-supported tiers. |

| 2024 trend in subscriptions (YoY) | ~+50% | ~−5% | Ad-supported grew sharply; ad-free declined modestly. |

| Consumer usage shift (2021–2024) | Rising usage | Falling share | More U.S. users engaging with ad-supported services. |

| Service example: Prime Video (2024) | ~80% viewers ad-supported | ~20% ad-free | Reflects default/shift to ad tier. |

| Broader CTV viewing split (Q1 2025) | ~72% ad-supported viewing | ~28% non-ad-supported | Ad-supported dominates overall TV time. |

| Global VoD revenue mix (2024) | AVOD rising (faster growth) | SVOD ~85% of revenue | SVOD still larger by revenue, but AVOD growing faster. |

For investment portfolios, Apple's Services division continues offering attractive growth prospects, with the TV+ price increase representing marginal revenue enhancement rather than fundamental strategy shift. However, investors should monitor competitive responses and consumer adoption patterns for insights into the sustainability of premium streaming pricing without advertising support.

The broader streaming inflation trend appears sustainable in the near term, supported by content cost pressures and investor profitability demands. However, consumer spending patterns and competitive dynamics will ultimately determine whether current pricing levels represent market equilibrium or temporary positioning ahead of further industry consolidation.

Market analysts recommend consulting financial advisors for personalized investment guidance. Past performance does not guarantee future results.