PubMatic Sues Google for Digital Advertising Monopoly Damages as Tech Firms Launch Legal Offensive Against Search Giant

Digital David Strikes Back: The Ad-Tech Uprising Against Google's Empire

How PubMatic's Bold Legal Gambit Signals a Seismic Shift in the $600 Billion Digital Advertising Landscape

NEW YORK — PubMatic Inc., a digital advertising technology company, filed a formal legal complaint against Google on Monday, September 8, 2025, seeking financial compensation for what it characterizes as years of anticompetitive behavior that damaged its business and the broader digital advertising ecosystem.

The lawsuit represents a direct response to findings from the U.S. District Court earlier this year, which determined that Google unlawfully operated as a monopolist in key segments of the digital advertising market. PubMatic, whose stock closed Monday at $8.37, has grown its market share from 2% to 4% over the past five years despite what CEO Rajeev Goel describes as competing on "a tilted playing field."

Founded in 2006 with the mission to improve online advertising efficiency through automated technology, PubMatic joins a growing roster of companies challenging Google's dominance in a global digital advertising market worth approximately $600 billion annually. The complaint alleges that Google's practices have "diverted billions in ad revenue away from independent platforms" and the publishers they support.

| Year | Market Size (USD Billions) |

|---|---|

| 2021 | 486.0 |

| 2023 | 679.8 |

| 2024 | 740.3 |

| 2025 | 798.7 |

| 2026 | 980.2 |

| 2028 | 965.6 |

| 2034 | 1,483.0 |

The Judicial Earthquake That Shattered Silicon Valley's Status Quo

The foundation for this legal offensive was laid in April 2025, when a federal judge delivered a verdict that reverberated through the technology industry: Google had unlawfully monopolized key segments of the digital advertising market, violating federal antitrust laws through systematic market manipulation and coercive bundling practices.

The court's findings revealed the mathematical precision of Google's dominance. The search giant controlled approximately 90% of publisher ad servers and ad networks, while commanding over 50% of ad exchanges—a vertical stranglehold that distorted competition and innovation for nearly two decades. More troubling were revelations of internal programs like "Project Bernanke," where Google covertly manipulated auction mechanisms to disadvantage competitors.

Google's "Project Bernanke" was an internal initiative identified in antitrust lawsuits as the company's alleged system to manipulate its online ad auctions. It reportedly involved using proprietary data to give Google an unfair advantage over competing ad exchanges and publishers.

For Rajeev Goel, who founded PubMatic in 2006 with the vision of democratizing digital advertising through automated technology, the ruling validated years of strategic persistence against overwhelming odds. Despite delivering genuine value to publishers and advertisers, PubMatic's market share had grown from just 2% to 4% over five years—a trajectory that Goel attributes directly to competing within Google's systematically advantaged ecosystem.

"The fact that we were able to double our market share from 2% to 4% in the last five years even in such an unfair environment is a testament to our team's dedication, creativity and relentless innovation," Goel wrote in announcing the lawsuit. "Imagine what we—and the entire industry together—could have achieved in a truly competitive and fair environment."

A Cascade of Corporate Resistance

PubMatic's legal action represents the visible manifestation of a much larger transformation. OpenX Technologies filed its own comprehensive antitrust lawsuit in August, alleging that Google's practices "crippled competitors at every turn." Across the Atlantic, 32 European media companies—including publishing giants Axel Springer and Schibsted—launched a €2.1 billion class action in the Netherlands, demanding compensation for lost advertising revenues.

The timing reflects carefully orchestrated momentum. These private lawsuits follow a coordinated regulatory offensive that has seen Google face a €2.95 billion fine from European authorities and an ongoing Department of Justice case that will reach its remedies phase on September 22, 2025.

This legal momentum coincides with broader technological shifts that are reshaping digital advertising. The rise of artificial intelligence, the growing importance of retail media networks, and increasing demand for transparent supply chains are all creating new competitive dynamics that could amplify the impact of any regulatory remedies.

"What we're witnessing is the collapse of the deterrent effect," explained a former antitrust official familiar with the cases. "Once courts establish liability, private actors become emboldened to seek damages."

The Mathematics of Market Domination

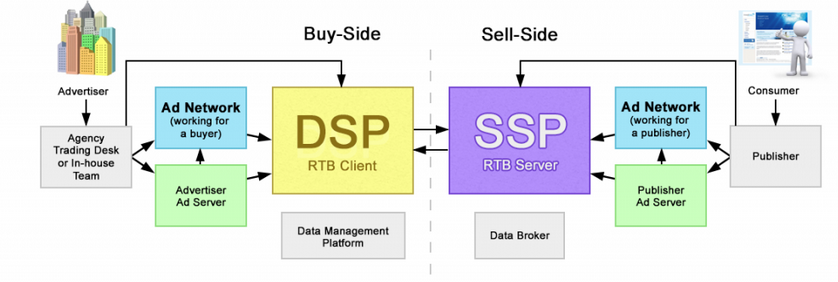

The financial stakes illuminate the scope of transformation ahead. Industry estimates suggest that Google's anticompetitive practices have diverted billions in advertising revenue away from independent platforms and the publishers they serve. The entire programmatic advertising market—where PubMatic competes—generates approximately $150 billion annually, with Google capturing disproportionate shares through its integrated technology stack.

The "Ad-Tech Tax" refers to the significant portion of an advertiser's budget consumed by various intermediaries within the programmatic advertising value chain. This "tax" means only a fraction of the original ad dollar ultimately reaches the publisher, highlighting the complex and often costly journey of an ad impression.

PubMatic's current valuation reflects the compressed economics that have characterized independent ad-tech firms operating under Google's structural advantages. Trading at $8.37 as of Monday's close, with intraday volume of 2,101 shares and a modest $0.05 increase from the previous session, the company's market performance suggests investors are beginning to price in the possibility of fundamental market restructuring.

But the implications extend beyond individual stock trajectories. A more competitive ad-tech landscape could enhance publisher revenues, improve advertiser efficiency, and accelerate innovation in emerging areas like connected TV and artificial intelligence-powered targeting.

"If the court forces functional neutrality at the ad-server layer, auction economics change overnight," noted a portfolio manager specializing in digital media investments. "Independents finally compete on merit rather than fighting Google's information advantages."

The Algorithmic Future of Fair Competition

Beyond immediate financial considerations, this legal confrontation touches fundamental questions about how algorithmic marketplaces should operate in democratic societies. The advertising technology stack has become critical infrastructure for journalism, content creation, and digital commerce—making its governance a matter of broad public interest.

Goel's vision extends beyond his company's immediate interests, articulating a transformation that could reshape how digital innovation unfolds. "At PubMatic, we believe in the power of fair competition, where publishers can monetize more effectively, advertisers can maximize the impact of their spend, and consumers can experience a richer internet with a greater diversity of ideas and content," he wrote.

The transformation ahead extends beyond traditional ad-tech boundaries. As artificial intelligence becomes central to advertising optimization, the companies that emerge stronger from this regulatory cycle will be better positioned to develop and deploy next-generation capabilities. This technological evolution could accelerate the shift toward more transparent, efficient advertising markets that better serve all participants.

Strategic Implications for Market Participants

For sophisticated investors, the lawsuit wave represents a compelling asymmetric opportunity with clearly defined risk parameters. The downside appears constrained—these companies have demonstrated operational resilience under monopolistic pressure—while the upside from market normalization could prove substantial.

Several factors support this analytical framework. First, the regulatory momentum appears irreversible, with enforcement actions spanning multiple jurisdictions and bipartisan political support. Second, underlying demand for programmatic advertising continues expanding, particularly in emerging formats like retail media and connected TV. Third, the artificial intelligence revolution is creating new opportunities for independent platforms to differentiate through specialized capabilities.

However, significant risks remain embedded in this transformation. Google commands vast legal resources and may pursue commercial retaliation against litigants. Extended court proceedings could drain smaller companies' resources without guaranteeing favorable outcomes. Most importantly, even successful antitrust enforcement might not translate into immediate market share gains if Google adapts its competitive strategies.

The remedies trial beginning September 22 will provide crucial signals about the scope and severity of potential structural changes. Court filings and testimony should reveal whether regulators favor behavioral modifications—such as transparency requirements and API access—or more dramatic structural remedies like forced divestiture of key assets.

Navigating the New Competitive Landscape

For investors considering exposure to this transformation, several principles emerge from current market dynamics. Companies with strong underlying fundamentals—like PubMatic's demonstrated ability to grow market share despite structural disadvantages—appear best positioned to capitalize on regulatory remedies. Firms with differentiated technology capabilities, particularly in emerging areas like artificial intelligence and connected TV, may benefit disproportionately from increased competition.

The timeline for meaningful change remains uncertain, requiring sophisticated risk management approaches. Legal proceedings often extend for years, and Google's resources ensure vigorous defense of its market position. Investors should expect continued volatility and consider hedging strategies that protect against adverse outcomes while maintaining exposure to potential upside.

As this complex legal and technological transformation unfolds, one certainty emerges: the digital advertising landscape that emerges from this regulatory crucible will look fundamentally different from the monopolized ecosystem that has dominated the past two decades.

"The future of this industry will not be decided by dominance or coercion, but by the strength of ideas, the power of innovation, and the trust we earn," Goel concluded. For companies like PubMatic, and the broader ecosystem of publishers, advertisers, and consumers they serve, that transformation represents both vindication and opportunity.

Disclosure: Past performance does not guarantee future results. Investors should consult with financial advisors before making investment decisions based on this analysis.